What Affects The Export Performance: A case study of Nafis Nakh Textile Company …

Intellectual Capital and Economic Value Added

Mahdi Beedel

Faculty of Administrative Sciences and Economics, Department of Accounting, University of Isfahan

Sasan Ghaffarifar

Department of Industrial Management, Qazvin Branch, Islamic Azad University, Qazvin, Iran

Mahmoud Mosafer

Department of Accounting, Abhar branch, Islamic Azad University, Abhar, Iran

The aim of this paper is to examine the impact of intellectual capital on the economic performance. To measure the intellectual capital, Value Added Intellectual Coefficient (VAIC) method, suggested by Pulic, has been used. VAIC measures the efficiency of three types of inputs: physical capital, human capital and structural capital.

Economic Value Added (EVA) has also been used to measure the economic performance. For this purpose, Nafis Nakh, as a successful and growth textile company was chosen for investigation. The study analyses firm’s resources and capabilities in a fourteen year period from 2004 to 2017 using annual time series data. Pearson Correlation Coefficient and Multiple Linear Regression Technique were used to test the hypotheses.

The results revealed that there was a significant positive relationship between intellectual capital and economic performance. Furthermore, the results indicated that structural and human capital had significant positive effects on financial performance of companies. Finally, we found no evidence that physical capital had any significant effect on the organizational performance.

As the industrial age ended, the advent of information technology saw an ever increasing significance of intellectual capital. This can be caused by factors such as the importance of the information technology revolution, the growing importance of knowledge and knowledge-based economy and the impact of creativity as a determinant element of competition (Guthrie, 2001).

In the field of organizational performance, managers always need to be aware of the importance of accounting in economy for decision-making in economic units, financial reports being considered an index for decision-making of investors.

The increase of the organizational performance is not the result of macroeconomic policies or financial balance, but the result of technical progress, innovation and quality of human, structural and relational factors that, in turn, are heavily influenced by investment in knowledge, education, research and development (Seleimet al, 2004).

Nowadays efficient use of the intellectual capital determines the success or failure of any firms while buildings and equipment, could not be considered as competitive advantage differentiator (Sonnier et al, 2007). The market value of the leading organizations is much higher than their book values. This difference is interpreted as intellectual capital (Standfieid, 2005).

Companies use both tangible and intangible assets in order to run profitable and competitive strategies. The first type such as machinery and equipment, buildings and other physical facilities are generally visible and replaceable. In addition, these assets easily traded in the market although the second type, intangible assets, is generally invisible, valuable, rare and irreplaceable (RiahiBelkaoui, 2003).

Although most intangible assets cannot be considered as strategic, intellectual capital is a vital strategic asset for any company (Mouritsen et al, 2004).

In the knowledge era, where intellectual capital represents a large part of the value of a product, the traditional annual financial statements report only partially the value of intangible assets (concessions, licenses, patents, trademarks, etc.) (Gogan et al, 2016).

So in order to achieve the strategic goals and performance improvement, any company should not only identify measure and manage these strategic intangible assets, but it should also try to continually upgrade and improve it. The main problem here is the measurement of intellectual capital in organizations.

Pulic (2000) develop a suitable method for measuring the intellectual capital, he argued that the market value of the companies is created by capital employed and intellectual capital and also intellectual capital is composed of structural capital and human capital. In this well-known method, the information about value creation efficiency is measured by both intangible (human capital and structural capital) and tangible assets of an organization.

Also VAIC is an approved method for measuring intellectual capital because all of the data used in this method is based on accounting data that are observable and verifiable (Firer and Williams, 2003).

In traditional business environment, organization tends to focus on tangible assets to increase the performance of organizations. But in turbulent business culture now organizations are more focus on knowledge or intellectual assets to increase value base efficiency and how value base efficiency increases the financial performance of corporate sector (Rehman et al, 2011).

Therefore, this paper focuses on the importance of the intellectual capital in order to increase organizational performance.

To achieve this goal, it is necessary to consider an appropriate measure to evaluate the economic performance of companies. This criterion should be devoid of traditional accounting measures disadvantages such as capability of manipulation, having a short-term view and dealing with firm value (Penman, 2010).

Economic Value Added is a valid measure of performance. EVA which has made on the base of enterprise value evaluation theory measures a company’s real profitability; it has been adopted by such prominent corporations as Coca-Cola, Eli Lilly, and Siemens AG-with spectacular financial results.

Economic Value Added is a measure of corporate performance that differs from most others by charging profit for the cost of all the capital a company employs, including equity to help translate principle into real-world practice (Woods et al, 2012; Xin et al, 2012). The main advantage of this criterion is its positive correlation with stock prices. Thus, the criterion is used by the analysts to find

out the overvalued stocks (Brigham et al, 1996). Therefore, in the present study, the economic value added is considered to measure the economic performance of companies.

Regarding the points mentioned, the main objective of the current research is to examine the relationship between intellectual capital and corporate performance and also the impact of intellectual capital components on corporate performance.

Due to the importance of the field, many studies have been conducted in several countries. Xu et al. (2017) have subdivided the Intellectual capital (IC) into human capital (HC), innovation capital (INC) and structure capital (SC) to explore the relationship between the performance of IC and EP through data collected from 35 Chinese enterprises.

They found that while the human and structural components of IC exert a significant positive influence on enterprise performance, innovation capital does not.

Gogan et al. (2016) investigated the relation between the intellectual capital and the organizational performance in four companies operating in the distribution of drinking water, between 2010 and 2014. Four hypotheses were determined and the results showed that there is a significant relationship between the intellectual capital and organizational performance.

Ozkan et al. (2017) have analyzed the relationship between the intellectual capital performance and financial performance of 44 banks operating in Turkey between 2005 and 2014 through the value added intellectual coefficient (VAIC) methodology. According to their findings, in terms of bank types, development and investment banks have the highest average VAIC. They also observed that capital employed efficiency (CEE) and human capital efficiency (HCE) positively affect the financial performance of banks.

However, CEE has more influence on the financial performance of banks compared to HCE.

Lu et al. (2014) applied the dynamic slack-based measure (DSBM) model to examine the relationship between intellectual capital and performance of 34 Chinese life insurance companies for the period 2006–2010, using the truncated regression approach. The findings reveal that intellectual capitals are significantly positively associated with firm operating efficiency, corroborate prior studies which show that intellectual capital can make a company rich.

Hsu (2012) investigated the effect of intellectual capital on Performance and the mediatin role of dynamic capability using pooled data of 242 high technology firms. In this study, the scope of intellectual capital includes human capital, relational capital and structural capital. Results from Bayesian regression analysis suggest that the effect of structural capital on performance is completely mediated by dynamic capability.

Ahangar (2011) conducted the study by employing the VAIC™ to measure the intellectual capital performance and its impact on financial returns of Iranians companies. He concluded that human capital efficiency has significant and positive impact on financial returns of companies whereas the relationship of structural and physical capital was not significant with financial performance of companies.

Samiloglu et al (2006) examined the relationship between value added intellectual coefficient (VAIC) and the ratio of market value to book value in the Turkish banking sector. The results of their study indicated that there is a significant correlation between the dependent variable (ratio of market value to book value) and the independent variable (VAIC) and its three components. In general, the literature review indicated that there is a significant positive association between intellectual capital and different aspects of firms’ performances.

Our analysis is based on data from Nafis Nakh, a successful and growth Textile Company in different terms of performance. The study analyses firm’s resources and capabilities in a fourteen year period from 2004 to 2017 using annual time series data.

In the present study, in order to calculate the intellectual capital, Pulic (2000) approach called VAIC method was employed. His model assigns explicit economic values, value added (VA) and capital employed (CE) to human capital (HC) and structural capital (SC) and on this basis generates an unambiguous Value Added Intellectual Coefficient (VAIC) index. VAIC has been used in various regional and national analyses to study the performance of individual companies. It has also been frequently quoted in academic research. VAIC model includes four variables:

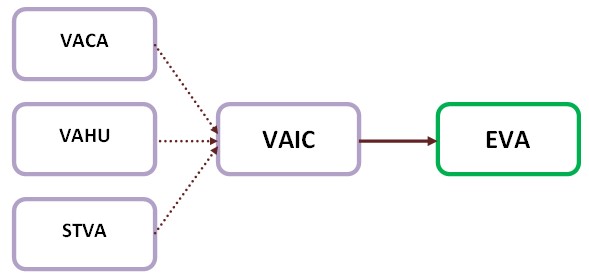

That is measured through value added intellectual coefficient (VAIC) by pulic is defined as a knowledge that can be converted to value (Edvinson and Malon, 1997). Pulic (2000) develop a suitable method for measuring the intellectual capital. this method is called VAIC and it indirectly measure intellectual capital through the value added efficiency of physical capital (VACA), value added efficiency of human capital (VAHU) and value added efficiency of structural capital (STVA) (Maditinos et al, 2011).

That is measured through value added efficiency of physical capital (VACA) by Pulic method, represents the value added created by the firm’s tangible assets.

That is measured through value added efficiency of human capital (VAHU) by Pulic method, is experience and expertise of employees which increases the efficiency of organizations. More efficient employee means more efficient of organization to boost value added (Bontis et al., 2000).

That is measured through value added efficiency of structural capital (STVA) by Pulic method, is another important determinant of IC. It consists of all non-human assets. It recognized as all systems, procedures, databases, copy rights, patents, structural procedures, rules and policies which are important for decision making (Bontis et al., 2000).

The VAIC model is intended to measure the extent to which a company produces added value based on intellectual (capital) efficiency or intellectual resources. VAIC calculations are based on:

| (1) | Output = Net Premium. |

| (2) | Input= Operating expenses (excluding personal costs and depreciation). |

| (3) | Value added =output-input. |

| (4) | HC =personal cost (salaries and wages), considered as an investment. |

| (5) | CE= Capital employed (both physical and financial capital). |

| (6) | SC= VA–HC. |

Physical Capital that is measured through value added efficiency of physical capital (VACA) represents the value added created by the firm’s tangible assets:

| (7) | VACA= VA/CE (value added efficiency of physical capital). |

Human Capital that is measured through value added efficiency of human capital (VAHU) is experience and expertise of employees which increases the efficiency of organizations:

| (8) | VAHU =VA/HC (value added efficiency of human capital). |

Structural Capital that is measured through value added efficiency of structural capital (STVA) consists of all non-human assets:

| (9) | STVA = SC/VA (value added efficiency of structural capital). |

Value added intellectual coefficient (VAIC), is the composite sum of the three separate indicators:

| (10) | VAIC = VACA +VAHU + STVA |

In a similar method, VAIC index calculation has the following steps:

As an intermediate result intellectual capital efficiency (ICE) is defined as ICE = HCE + SCE and finally

VAIC = ICE + CEE

Figure 1. Construction of the Value Added Intellectual Coefficient (VAIC)

Figure 1. Construction of the Value Added Intellectual Coefficient (VAIC)

In the present study, the first method steps (1 to 10) were used in order to calculate the Value Added Intellectual Coefficient (VAIC).

3.1.5. Economic Value Added (EVA)

Economic value added (EVA) is a measure of a company’s financial performance based on the residual wealth calculated by deducting its cost of capital from its operating profit, adjusted for taxes on a cash basis. EVA can also be referred to as economic profit, as it attempts to capture the true economic profit of a company. This measure was devised by management consulting firm Stern Value Management, originally incorporated as Stern Stewart and Co. EVA is a way to measure the actual profitability of the company’s operations. In calculating the economic value added, the emphasis is on the effectiveness of management in a given year (Brigham et al., 1996).

In order to calculate the economic value added (EVA), method of Brigham et al (1996) is used as following steps:

| (11) | EVA= NOPAT– Capital charges. |

| (12) | NOPAT = (Profit Befor Taxes and Interests) × (1- Tax rate). |

| (13) | Capital Charges = Total Operating Capital × (WACC). |

| (14) | Total Operating Capital = Net Operating Working Capital + Net Fix Assets. |

In the above equations, EVA is firm’s economic value added, NOPAT is Net Operating Profit after Tax and WACC is the weighted average of capital cost.

The calculation shows how and where a company created wealth, through the inclusion of balance sheet items. This forces managers to be aware of assets and expenses when making managerial decisions. However, the EVA calculation relies heavily on the amount of invested capital, and is best used for asset-rich companies that are stable or mature. Companies with intangible assets, such as technology businesses, may not be good candidates for an EVA evaluation. In the present study, this variable is calculated in million rupiahs and is changed into natural logarithm (Ln).

Through the analysis of studies in the field, it can be claimed that there is a significant relationship between intellectual capital and firm’s performance. Considering the advantages of economic value added as a measure of corporate performance and the VAIC method in order to measure the intellectual capital, in this paper, effort was made to examine the relationship between intellectual capital and economic value added and secondly, evaluate the impact of each component of intellectual capital on the economic value added of Nafis Nakh Textile Co. To do so, the following hypotheses were tested:

H1. Value Added Intellectual Coefficient (VAIC) is positively associated with the economic value added (EVA).

H2. Value Added efficiency of Physical Capital (VACA) has a positive impact on economic value added (EVA).

H3. Value added efficiency of Human Capital (VAHU) has a positive impact on economic value added (EVA).

H4. Value Added efficiency of Structural Capital (STVA) has a positive impact on economic value added (EVA).

Figure 2. Conceptual model of the study

Figure 2. Conceptual model of the study

The hypothesis presented in the previous section will be tested in times series data of Nafis Nakh Co, for the period of 2004-2017. Pearson correlation coefficient was employed to examine the relationship between intellectual capital and EVA.

Furthermore, in order to test hypothesis number 2, 3 and 4, we estimate the following regression that examines the effect of intellectual capital components on EVA.

| (15) |

Where EVAt, as the Dependent variable, denotes firm’s economic value added at month (t). Other variables in the model including independent variables are: VACA the Value Added efficiency of

Physical Capital; VAHUt denotes the Value added efficiency of Human Capital; STVAt denotes the Value Added efficiency of Structural Capital and ε is the random errors of the regression models.

Ordinary least squares (OLS) or linear least squares is a method for estimating the unknown parameters in a linear regression model. OLS chooses the parameters of a linear function of a set of explanatory variables by minimizing the sum of the squares of the differences between the observed dependent variable (values of the variable being predicted) in the given dataset and those predicted by the linear function (Brooks, 2014).

Our analysis is based on data from firm’s internal information especially its financial statements and the statistics produced and published by Tehran Stock Exchange (TSE).

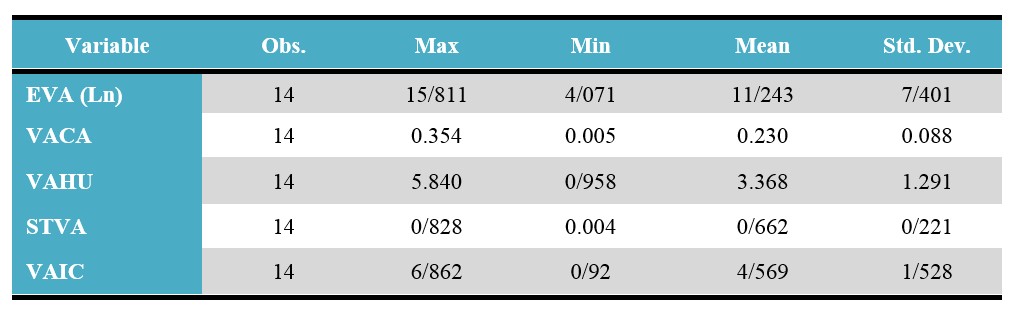

Table 1. Summery Statistics

This paper investigates the impact of intellectual capital on the economic performance. In this section, we examine the impact of each factor on firm economic performance through testing the research hypotheses.

Table (2) contains the results of correlation test that examined the relationship between intellectual capital and EVA.

Table 2. Correlation Test Results

| The correlation between the coefficient value added of intellectual capital and economic value added | Pearson correlation | Sig (2-tailed) | Number |

| 0.709** | 0.004 | 14 |

**Correlation is significant at the 0.01 level (2-tailed).

Regarding the significant level (Sig=0.000) which is less than test level (α=0.05), with a 99% certainty, it can be claimed that there is a significant positive relationship between value added coefficient of intellectual capital (VAIC) and the economic value added (EVA). Thus, the first hypothesis of the research is confirmed.

To test the hypothesis 2, 3 and 4, the econometric model of the study (equation 15) was identified, which aimed to test the effects of intellectual capital components on EVA.

Table (3) contains the OLS regression estimates of equation (15).

Table 3. Ordinary least squares (OLS) regression results of model 15

| Variables | Coefficient | t-Statistics | Prob | Adj R2 | F-Statistics | Prob |

| Intercept | -47/573 | -2/051 | 0.054 | 0/529 | 20/228 | 0/000 |

| VACA | 0/549 | 967/0 | 345/0 | |||

| VAHU | 15/064* | 3/348 | 0/003 | |||

| STVA | 6/943* | 2/200 | 0/028 | |||

* Significant at the level of 95 percent

Three hypotheses were supported as illustrated in Table (3). The results appear economically significant according to Adj R2, F-Statistics and Prob statistics.

The VACA coefficient is positive (0/549) but it takes a p-value (0/345) suggesting that this variable is not significantly different from zero. So the null hypothesis cannot be rejected. Thus, the second hypothesis of the study is rejected.

The VAHU coefficient is positive (15/064) and significant, suggesting that value added efficiency of human capital has a positive impact on economic value added (EVA). Thus, the third hypothesis of research is confirmed.

Finally, the STVA coefficient is (6/943) and significant, suggesting that value added efficiency of structural capital has a positive impact on economic value added (EVA), reflecting that higher structural capital is correlated with higher export performance. Thus, the hypothesis no.4 of the study is confirmed.

Intellectual capital (IC) is a relatively recent line of research that has received increasing scholarly interest with the continuing growth and development of the global knowledge economy. In a competitive environment, Because of the increasing knowledge-based economy and knowledge management in modern organizations, intellectual capital seems to be more valuable than any physical assets. Several IC models have been developed in an attempt to operationalize the essence, function and benefits of IC.

The methodological challenge in developing these models is to find ways in which to reliably identify IC and its economic impact, and on the other hand to find out how IC can be optimized with a view to boosting economic growth.

In this study, efforts were made to evaluate the impact of intellectual capital on the economic performance. The explanatory model was fit to 14 years annual time series data from Nafis Nakh Textile Company. The VAIC method developed by Ante Pulic (2000) was considered to measure intellectual capital.

It calculates both the overall efficiency of a company and its intellectual capital efficiency (ICE) while both intellectual capital and physical capital are considered as investments. Also economic value added (EVA) was employed to measure the economic performance.

Economic Value Added (EVA) is a measure of financial performance based on the concept that all capital has a cost and that earning more than the cost of capital creates value for shareholders. It is true economic profit consisting of all costs including the cost of capital.

In order to evaluate the impact of intellectual capital components on the economic value added, 4 hypotheses were tested through employing Pearson correlation coefficient and multiple linear regression technique. Finally empirical results were identified through testing the research hypothesis.

First, for the value added intellectual coefficient (VAIC), as expected, the results imply that there is a strong positive association between the value added intellectual coefficient and the economic value added, confirming that intellectual capital improvements leads to higher performance.

In order to investigate the effects of value added efficiency of human capital (VAHU), strong significant positive effects were found as it was expected. It means that investments on human capital lead to higher productivity. Value added efficiency of structural capital (STVA) was also found to have significant and positive effects on economic performance of the company.

Thus, the structural capital that includes systems, procedures, databases, copy rights, patents, structural procedures, rules and policies, play a significant role in the growth and development of the company. Finally we found no evidence that the Value added efficiency of physical capital (VACA) had any significant effects on the economic performance of the company.

This study has also confirmed some results found in the literature, while the developing country setting contributed to the external generalizability of past findings.

The results are consistent with the findings of Tan (2007), Zéghal (2010) and Abbasi (2011), Yalma (2007), Appuhami (2007) and Alipour (2012).

Our study has a number of limitations which might usefully be addressed in future analyses. First of all, the time series nature of the data used here and the OLS method limits on our ability to identify causal relationships. Second, although there are several indicators of intellectual capital and its components, Pulic approach called VAIC method was employed that has its own defects and needs for caution.

In Pulic’s formula, structural capital (SC) is calculated as the difference between a company’s value added (VA) and its human capital (HC) (SC = VA – HC). There is, however, no reason to class the SC variable as structural capital. The calculated parameter SC is purely a traditional accounting and financial variable, which is comparable to operating margin or operating result.

In the last stage of the VAIC formula, a company’s so-called intellectual capital efficiency (ICE) is defined, as is its value added intellectual coefficient (VAIC). The company’s ICE is obtained by adding together its human capital efficiency (HCE) and structural capital efficiency (SCE).

However, nothing in the calculation gives reason to talk about intellectual capital, as the variables are purely financial parameters and variables related to labour efficiency. The variable has a clear connection to the index measuring the real productivity of labour, and is merely a more complicated version of it, which in reality describes the overall labour productivity of a company. VAIC is obtained as the sum of a company’s overall labour productivity (ICE) and the efficiency of its capital invested.

However, nothing in the calculation in regard to this gives reason specifically to emphasize intellectual capital. Instead, the parameter is chiefly an efficiency parameter, which combines labour productivity and capital productivity or efficiency as a parameter measuring overall productivity.

Finally, from a methods standpoint, there is a possible bias of collecting information retrospectively and prospectively, and a possible survivor bias.

Abbasi, E. and Galdi, A. (2011). The Influences survey of the Intellectual Capital elements efficiency on the firm’s Financial Performance in Tehran Stock Exchange. Journal of Accounting and Auditing Review, 17(2): 57-74.

Ahangar, RG. (2011). The relationship between intellectual capital and financial performance: An empirical investigation in an Iranian company. African Journal of Business Management, 5(1): 88-95.

Alipour, M. (2012). The effect of intellectual capital on firm performance: an investigation of Iran insurance companies. Measuring Business Excellence, 16(1): 53 – 66.

Appuhami, R. (2007). The impact of intellectual capital on investors’ CapitalGain on Shares: An empirical investigation in Thai banking, finance & insurance sector. Journal of Internet Banking and Commerce, 12(1): 1-14.

Brigham, FE., Gapenski LC. and Davis, R. (1996). Intermediate Financial Management. 6th ed, Dryden Pr.America.

Brooks, C. (2014). Introductory Econometrics for Finance. 3rd Ed, Cambridge University Press.

Bontis, N., Keow, WCC. and Richardson, S. (2000). Intellectual capital and business performance in Malaysian industries. Journal of Intellectual Capital, 1(1): 85-100.

Edvinsson, L. and Malone, MS. (1997.) Intellectual Capital: Realizing Your Company’s True Value by Finding Its Hidden Brainpower. Harper Business, New York, NY.

Firer, S. and Williams, SM (2003). Intellectual capital and traditional measures of corporate performance. Journal of Intellectual Capital, 4 (3): 348-60.

Guthrie, J. (2001). The Management, Measurement and the Reporting of Intellectual Capital. Journal of intellectual capital, 2 (1): 27-41.

Hsu, LC. (2012). Clarifying the Effect of Intellectual Capital on Performance: The Mediating Role of Dynamic Capability. British Journal of Management, 23(2): 179-205.

Laing, G., Dunn, J. and Lucas, SH. (2010). Applying the VAIC model to Australian hotels. Journal of Intellectual Capital, 11(3): 269-283.

Maditinos, D., Chatzoudes, D., Tsairidis, C. and Theriou, G. (2011). The impact of intellectual capital on firms’ market value and financial performance. Journal of Intellectual Capital, 12(1): 132-51.

Mouritsen, J., Nikolaj, PN. and Marr, B. (2004). Reporting on Intellectual Capital: Why, What and How? Journal of Measuring Business Excellence, 8(1): 46-54.

Penman, H. (2010). Financial statement analysis and security valuation, 4th ed, Mc Graw Hill.

Pulic, A. (2000). VAIC – an accounting tool for IC management, International Journal of Technology Management, 20(5): 702-14.

Rehman, W., Rehman, C., Rehman, H. and Zahid, A. (2011). Intellectual Capital Performance and Its Impact on Corporate Pperformance: An Empricial Evidence From Modaraba Sector Of Pakistan. Australian Journal of Business and Management Research, 1(5): 8-16.

Riahi-Belkaoui, A. (2003). Intellectual Capital and Firm Performance of US Multinational Firms. Journal of Intellectual Capital, 4 (2): 215-226.

Samiloglu, AT. (2006). The performance analysis of the Turkish banks through VAIC and MV/MB ratio. Journal of Administrative Sciences, 4(1): 207-26.

Sonnier, BM., Carson, DC. And Carson, PP. (2007). Accounting for Intellectual Capital: The Relationship between Profitability and Disclosure. Journal of Applied Management and Entrepreneurship, 12 (2): 3-14.

Tan, HP., Plowman, D. and Hancock, P. (2007). Intellectual capital and financial returns of companies. Journal of Intellectual Capital, 8(1): 76-94.

Woods, M., Taylor, L. and Cheng, GF. (2012). Electronics: A case study of economic value added in target costing. Management Accounting Research, 23(4): 261-277.

Xin, Z., Ting, W. and Yuana, Z. (2012). Economic Value Added for Performance Evaluation: a Financial Engineering. Systems Engineering Procedia Special Issues, 5: 379–87.

Yalama, A. and Coskun, M. (2001). Intellectual Capital performance of quoted banks on the Istanbul stock exchange market. Journal of Intellectual Capital, 8: 256-271.

Ze´ghal, D. and Maaloul, A. (2010). Analyzing value added as an indicator of intellectual capital and its consequences on company performance. Journal of Intellectual Capital, 11(1): 39-60.

Enter your contact number Our partners will contact you as soon as possible

User comments